Hey! Happy Sunday! Matt here.

Welcome to the Construction Curiosities newsletter!

After taking a newsletter week off last week, we pick right back up where we left off: Talking about Contract language. Let’s dig into how Retainage is making the Yeti look like the Broke Monopoly Man.

Summary

This week we will look at:

One Musing: Contract Retainage

Construction Confidence Index

One Meme: Longing for the Retention Release

Contract Retainage: The Cash-Flow Killer Everyone Just Accepts

Ever wonder why every trade’s CFO looks as exhausted as the crew at 95% complete?

Spoiler: it’s not the punch list. It is the interest-free loan that every tier is forced to make to the one above it. The industry calls that loan retainage. Owners love it, GCs tolerate it, and Subs are stuck with most of their Project’s profit held like a prize at the end the project.

What “10%” Really Means on a Project

Standard contracts slice 5 to 10 percent off every pay app and stash it “for safety.” That rate is baked into government regulations and most contract templates.

Let’s look at an example of a $10 million commercial job, where a flat 10% holdback parks $1 million in the Owner’s account for months. That might keep lenders and risk managers warm at night, but everyone else is scrambling for payroll.

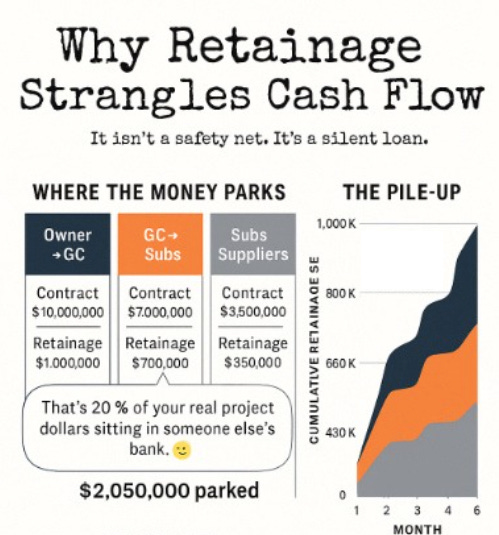

Now stack the chain:

Owner withholds $1 M from the GC.

GC withholds $700 K from its Subs.

Subs withhold $350 K from Specialty Subs or Suppliers.

The aggregate financing pain is $2.05 million. 😵💫

Or the even worse case scenario: the subcontractor gets pinched. They have 10% of the materials value held in retention BUT can’t pass that along and is not only financing the labor but also the supplier’s materials.

Why Owners Like It (and Why They Should Still Rethink It)

Retainage is cheap leverage. Owners believe it guarantees quality and covers completion risk. Fair enough. But starving the supply chain slows production, breeds corner-cutting, and spikes financing costs which the owner’s actually end up paying for.

Better idea: Find innovative solutions to ensure completion and release chunks of retainage when verified milestones hit, such as Topping Out, HVAC start-up, Watertight Envelope, Substantial Completion & finally Closeouts. You get performance and motivated subs.

The Middleman’s Dilemma

GCs sit in the splash zone. They sometimes float subs, suppliers, and their own overhead while waiting for the Owner’s check. They want to keep their subs happy and making their projects the subs’ priority, and proactive GCs will many times go to bat for early release, but most of the time they live on a paid when paid clock, so if they don’t get it from the Owner, the Subs are SOL.

Pro Tip from an Owner’s Rep: Releasing retention early is all about trust. Do we trust you to finish? And the finish line is all the way through the Punch List and Closeout Docs.

Many times, Owners are forced to keep holding retention for months after Substantial Completion because the GC sees that as the finish line and then turns their attention elsewhere.

How can we trust that you are going to finish the Closeouts timely? Well, how about starting to compile them well before the end? Show them you are keeping up with your as-builts & redlines as the project goes and not waiting til 14 months after ground breaking. Work on getting Owner’s Training on the calendar before you hit Substantial. Talk through what the warranty process will look like well before you are in that phase.

Show you are being proactive in this step. And the Owner will be more likely to trust you aren’t going to ghost them at the end, and more likely to cut back on that final hold.

Subcontractors: Financing the Whole Circus

Due to payment cycles, Subs already front-load labor and material. Tack on a 10 percent holdback, and many are financing an extra third of their cost of goods. If they don’t have the cash, they borrow at 8 percent APR, which means a $1 million gap costs roughly $40k over a six-month schedule. That interest is pure waste, money that could go to team project bonuses or funding innovation programs instead of lining a bank’s pocket.

My heart always goes out to the Subcontractor world, because they are the ones that are actually building the project yet they are at the bottom of the hill contractually and all the shit rolls down hill.

Know what the Law Says (And What It Doesn’t)

Make sure you know the law in the state and jurisdiction in which you are working. It’s not the same everywhere. Federal & State laws cap and provide other limitations and expectations on retainage holding.

For instance, some states have moved to limit the max to 5%. And for some public projects (like in Texas), if more than 5% is withheld, it has to be held in an interest-bearing account, and the Owner has to pay the interest on top of the held amount.

Tools to Kill the Pain Without Killing Protection

Bonded retainage. Swap the cash for a surety bond. The owner still has coverage, & the contractor keeps working capital.

Escrow with interest split. Money is locked, but everyone sees the balance and earns a little juice.

Sliding-scale holdbacks. 10% at the start, 5% after 50 percent complete, 2% once systems start up, and an absolute minimum to cover the punch list & closeouts. (Again, this is built upon trust. As a contractor, do everything you can to build this trust early!)

Smart-contract pay apps. Software auto-releases retainage at predefined milestones so nobody “forgets” to cut the check.

None of these ideas are radical. They just require the will to rewrite a clause everyone swears is “industry standard.”

Tear Up the Boilerplate

A little challenge for this week:

Pull your current contract. Highlight the retainage paragraph. Ask two questions:

Does this language actually lower my risk, or does it just hoard cash and suffocate the trades that are actually building my project?

Could milestones, escrow, or a sliding scale give the same safety without starving the job?

If the answer to either question is “maybe,” break out the red pen. Shoot me your updated clause, and/or your nastiest retainage horror story. I’ll put the best submissions in next week’s newsletter. Let’s crowdsource some ways to make this a better place and get back to building. 😎

Construction Confidence Index - May Edition

The team at Foundamental has been pumping out some killer content this year. And that includes this Construction Confidence Index.

Foundamental’s Construction Confidence Index crunches 2,000-plus AEC-tech news pieces each month with an AI sentiment engine and spits out a score from -1 (panic 😱) to +1 (party 🎉).

TDLR: May clocked in at +0.348, fifth month in the green, with execution stories beating pitch-deck hype. Market-expansion sentiment tops funding talk, India leads the optimism, the UK drags, and robotics + supply-chain tech grab the spotlight.

Catch the whole thing here: Foundamental CCI

One Meme

If you are a GC and play this game… we aren’t friends anymore. ☹️

Construction Curiosities is a reader-supported Newsletter. Please consider upgrading your subscription to help support the work we are doing. With your support, we have more big things planned and in the works.